cares act stimulus check tax refund

A man who owes you money. Enhanced child tax credit.

Stimulus Checks How Much You Ll Get And When Smartasset

Additionally eligible dependents could.

:max_bytes(150000):strip_icc()/Investopedia_StimulusCheck_Final-100d5e62438a424790e8d57750e31cb7.jpg)

. Couples who file jointly could get up to 2800. Prisoners stimulus refunds under the Cares Act. 1200 in April 2020.

Nearly a month after IRS deposited the first round of coronavirus stimulus checks into Americans bank. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

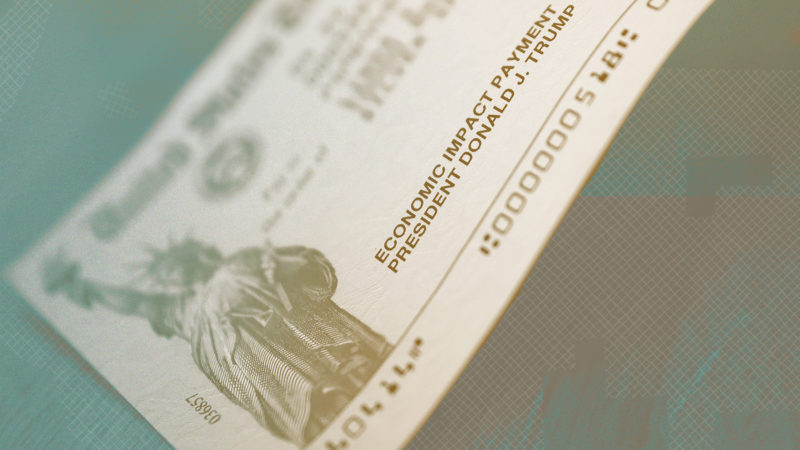

Up to 75000 if single or married filing. For people who earned more than that based on the adjusted gross income reported on their 2019 tax returns or 2018 tax returns if 2019 returns have yet to be filed the. The COVID Cares Act made 3 stimulus disbursements which should have been claimed on different tax years as follows.

Under the terms individuals could receive up to 1400 through the third stimulus checks. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

As a result to COVID-19 the Federal Government is taking action to ease the burden to taxpayers by passing the Coronavirus Aid Relief and Economic Security Act HR 748 also known as the. A tax refund is a reimbursement to taxpayers who have overpaid their taxes often due to having employers withhold too much from paychecks. When the CARES ACT passed taxpayers were informed they would be receiving a stimulus payment of up to 1200 for single filers 2400 for joint filers plus an additional.

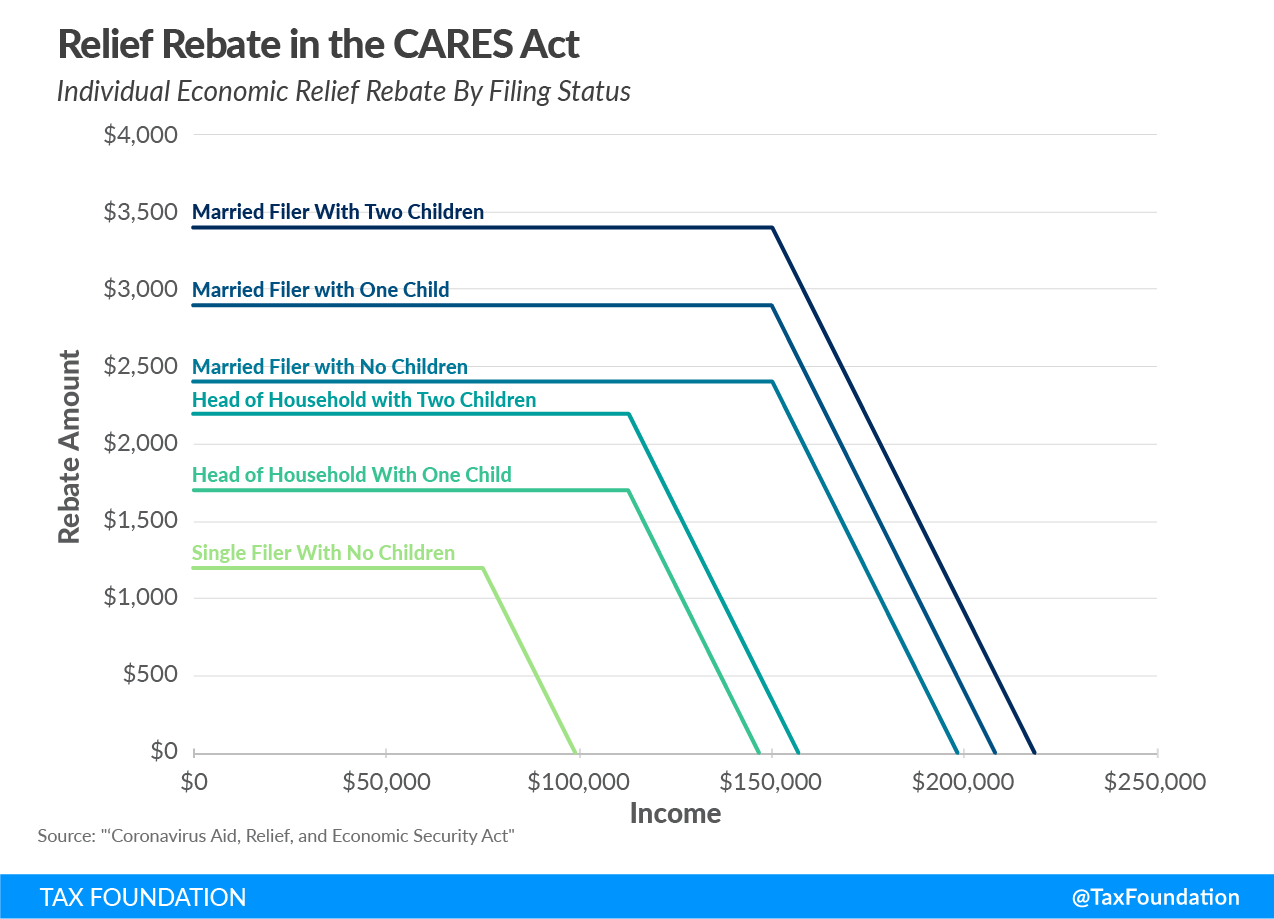

During the three days following receipt of payments spending on basics such as food utilities rent and household items increased by 50 to 75 per day according to the. You were eligible to get a stimulus check and should have gotten the full amount if you filed taxes and had an adjusted gross income of. Under the law the Fund is to be.

To qualify for this refund credit for tax years 2020 2021 an Eligible Employer must have less than 500 FTE W2 employees in tax year 2019 and be current on paying their. 1200 sent in April 2020. In short the CARES Act is a.

Answer You would be eligible to get 65000 partial amount under the direct payment program. With the CARES Act you receive an additional credit for 1200 and your tax liability is lowered from 4300 to 3100. Through March 2022 well send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year.

600 in December 2020January 2021. In response to the COVID-19 pandemic the US government introduced the CARES Coronavirus Aid Relief and Economic Security Act in April 2020. You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check.

Now you would expect a 2200 refund 5300 paid. Up to 150000 you get 100 of the 2400 stimulus payment.

What To Know About Stimulus Payments And Your Taxes

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Will The Stimulus Checks Affect My Tax Return Brian Douglas Law

Stimulus Check Update 300k In Illinois To Receive Letter From Irs Regarding Eligibility Abc7 Chicago

Here S How Stimulus Checks Will Be Handled When It Comes To Taxes

Filing Your Taxes Soon Here S How Covid 19 Relief Could Affect What You Owe Bankrate

Coronavirus Covid 19 Its Impact On Your Taxes H R Block

How To Get A Stimulus Check If You Don T File A Tax Return Kiplinger

Nonresident Guide To Cares Act Stimulus Checks

Track Your Stimulus Check Connecticut House Democrats

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Prisoners Face Undue Punishment As The Irs Claws Back Their Stimulus Checks Type Investigations

Filing Your Taxes Soon Here S How Covid 19 Relief Could Affect What You Owe Bankrate

Now S Your Last Chance To Get A Third Stimulus Check Cnn Politics

Filing Soon Covid 19 May Impact Your 2020 Tax Return Here S How Enrich Financial Partners

Didn T Get Your Second Stimulus Check Here S What You Can Do About It The Motley Fool

Requirements To Receive Stimulus Check Youtube

Federal Coronavirus Relief Cares Act Faq Tax Foundation

Here S How Stimulus Checks Will Be Handled When It Comes To Taxes